Some REALTORS® and brokerages have recently received a letter from the Oregon Department of Revenue reminding them that Oregon’s new Corporate Activity Tax goes into effect January 1, 2020. Here is what you need to know about the tax:

- Only applies to sales/revenue generated in Oregon

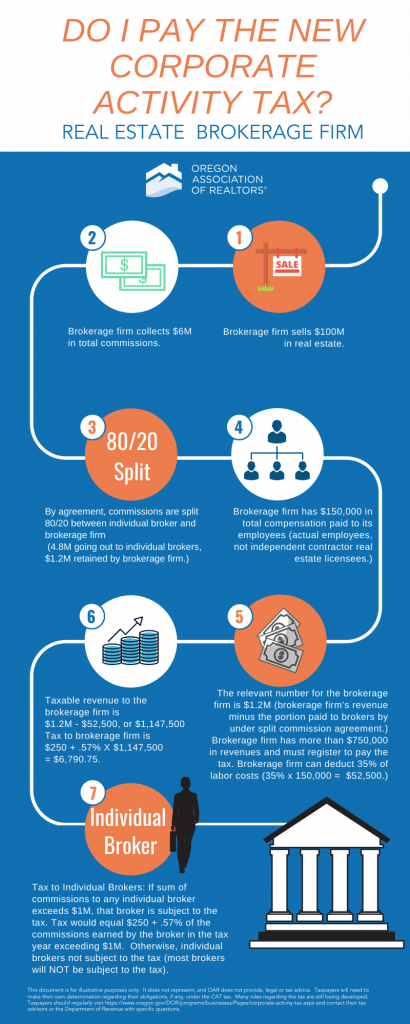

- Applies to all business types (including independent contractors and sole proprietors) with Oregon revenues in excess of $1M

- The value of real estate sold is irrelevant to the calculation of the tax

- Only revenue earned by the brokerage or broker is relevant

- For real estate brokerages operating under a split fee/commission arrangement with individual brokers, only the portion of the fee/commission that the brokerage keeps is considered revenue to the brokerage; only the portion of the fee/commission that the individual broker keeps is considered revenue for the individual broker

- Businesses with at least $750,000 in Oregon sales/revenue must register to pay the tax with the Department of Revenue once they cross that threshold

- Businesses with at least $1M in Oregon sales/revenue must pay the tax

- The tax is calculated as $250 + .57% of gross revenues, minus 35% of either

- Labor costs ((defined as total compensation excluding compensation in excess of $500k for any individual employee; commissions paid to independent contractor real estate brokers do not count as labor costs)

- Cost of Goods Sold (costs included under Chapter 471 of the Internal Revenue Code, typically not relevant for real estate brokerages)

- Rule-making to continue to flesh out all of the details of the tax is ongoing. To see draft rules for the tax, frequently asked questions, and to sign-up for email updates from the Department of Revenue, visit: https://www.oregon.gov/DOR/programs/businesses/Pages/corporate-activity-tax.aspx

Examples:

If you have questions about the tax or how it might apply to you, don’t hesitate to reach out to Jeremy Rogers at OAR. jrogers@oregonrealtors.org.